UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

Cognizant Technology Solutions Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

|

2020

Proxy

Statement

& Notice of

Annual Meeting

| Audit Matters | ||

| Independent Auditor | 58 |

Frequently Requested Information

| Board Refreshment | 6 |

| CEO Compensation Assessment | 40 |

| Clawback Policy | 47 |

| Compensation by NEO | 39 |

| Compensation Consultant | 32 |

| Compensation Mix | 29 |

| Death Benefits | 57 |

| Director Attendance | 10 |

| Director Biographies | 10 |

| Director Compensation | 26 |

| Director Diversity | 6 |

| Director Independence | 6 |

| Director Skills | 8 |

| Pay for Performance | 30 |

| Peer Group | 32 |

| Perquisites | 46 |

| Proxy Access | 7 |

| Related Person Transactions | 27 |

| Retirement Policy | 46 |

| Risk Oversight | 20 |

| Severance Benefits | 48 |

| Shareholder Engagement | 18 |

| Share Ownership | 25 |

| Shareholder Proposal Deadlines for 2021 | 61 |

| Sustainability | |

| Governance | 21 |

| Human Capital | 22 |

| Communities | 24 |

Cognizant Technology Solutions CorporationWhy are we sending you these materials?

On behalf of our board of directors, we are making these materials available to you (beginning on April 22, 2020) in connection with Cognizant’s solicitation of proxies for our 2020 annual meeting of shareholders to be held via live webcast on June 2, 2020.

What do we need from you?

Please read these materials and submit your vote and proxy using the Internet, by telephone or, if you received your materials by mail, you can also complete and return your proxy by mail.

To Our Stockholders:

We cordially invite you to attend our 2018 Annual Meeting of Stockholders, which will be held at the Teaneck Marriott at Glenpointe, 100 Frank W. Burr Blvd., Teaneck, New Jersey 07666, on Tuesday, June 5, 2018, at 8:30 a.m. Eastern Time.

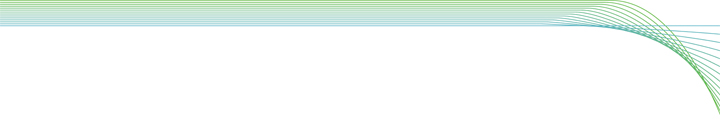

The digital marketplace is evolving quickly, with both exponential technical progress and an ever increasing rate of change. This context underscores why it is so important for Cognizant to have a diverse, fully engaged, and forward-looking board whose members bring deep knowledge of the many disciplines that are central to the company’s long-term growth. We have made a point of significantly refreshing our board, adding five independent directors over the last three years. These individuals are providing expertise in key enabling digital technologies, healthcare, corporate governance, and other areas.

Our newest director, Joseph M. Velli, joined the board last December. Mr. Velli served previously as Senior Executive Vice President and a member of the Senior Policy Committee of The Bank of New York (now BNY Mellon). His significant experience in creating, building and leading large-scale, technology and software platform businesses in the financial services industry is highly relevant to the company’s continuing expansion of digital services and solutions for banking and other clients.

We extend our deep gratitude to Robert E. Weissman, who retired from the board last December after 16 years of service to the company, its employees and stockholders. Instrumental in Cognizant’s formation, Mr. Weissman not only made our board stronger, he also helped to lead the company at every stage of its evolution through its current position of market leadership.

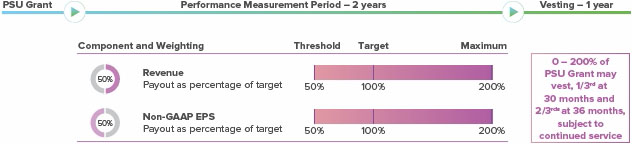

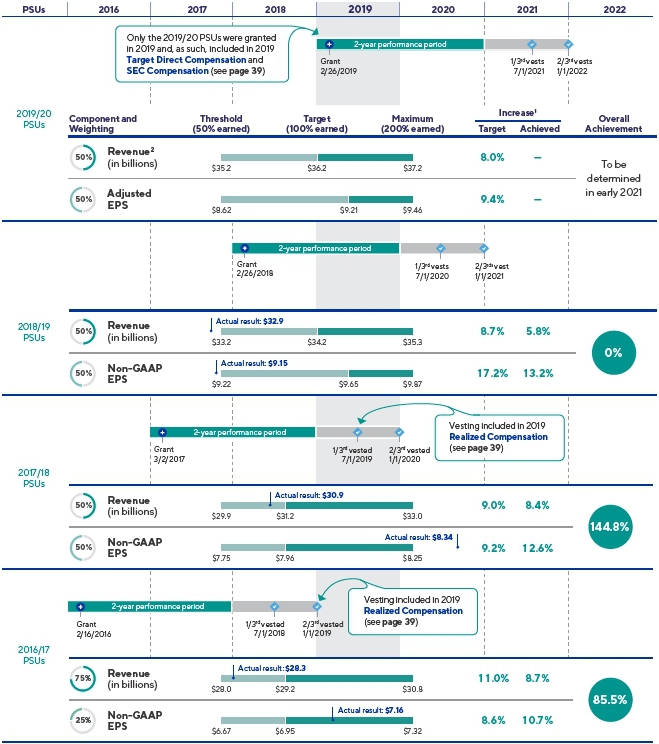

Cognizant operates with a commitment to align pay with performance to motivate and reward achievement of sustained strong financial and operational results. To that end, Cognizant’s executive officer total direct compensation packages, which consist of base salary, an annual cash incentive, and stock-based awards, reflect our strategic plan to drive higher levels of profitability while maintaining continued revenue growth. Accordingly, in 2017 the Compensation Committee shifted the weighting of non-GAAP EPS1as a performance measure to 50% for performance stock unit awards, with revenue accounting for the other 50%. (In 2016 the weighting was 25% non-GAAP EPS/75% revenue.)

Cognizant seeks to be a responsible and engaged corporate citizen, including in the communities in which it operates. We believe that the digital marketplace should create opportunities for all. Recognizing how often technological progress leaves some people behind, Cognizant has long believed that it has an obligation to enable a broader range of people to have the science, technology, engineering, and math (STEM) education and skills they need to thrive in today’s digital era. To augment its global STEM education efforts, which go back more than a decade, in February 2018 the company announced its intent to form Cognizant U.S. Foundation. This 501(c)(3) non-profit organization, to be established with an initial grant of $100 million, will support STEM and digital education and skills training for U.S. workers and students. This initiative is but one example of the company’s resolve to perform with purpose.

We encourage you to read the enclosed Notice of 2018 Annual Meeting and Proxy Statement, which include instructions on how to vote your shares by proxy and/or attend the meeting and vote in person.

We thank you for your continued support.

Sincerely,

|  |  |  | |||

|

| |||||

April 22, 2020

|

|

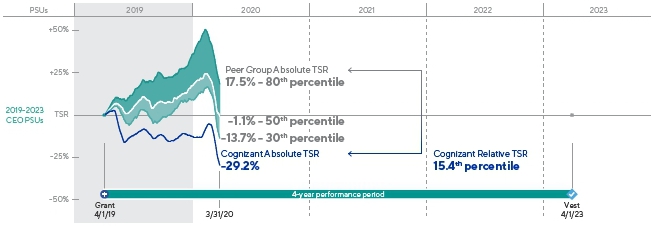

The last year has been one of transition and transformation at Cognizant. Brian Humphries joined the company as CEO on April 1, 2019, and a number of other new executives have been added since then. Management and the board have worked diligently to refine the company’s strategy and focus and make the changes and investments needed to reposition the company for accelerated growth and leadership in today’s advanced digital technologies.

Joining the company after the disappointing first quarter of 2019, Brian wasted no time in launching a transformation office to look for ways to get the company back on track from both a revenue growth and margin perspective. He and the management team, working closely with the board, set about refining the company’s strategy and developing the 2020 Fit for Growth Plan, both of which were reviewed by the board in detail at its annual strategy session held in September 2019. The company’s strategy has at its core two key strategic objectives: (i) protecting and optimizing Cognizant’s traditional business while scaling the business internationally where we believe there is significant growth potential; and (ii) winning across the four digital battlegrounds of artificial intelligence (AI) and analytics, digital engineering, cloud and Internet of Things (IoT) that are needed by clients to become fully digital businesses. Seepage 8. To achieve those strategic objectives, the 2020 Fit for Growth Plan involves, among other things, streamlining the company’s operating model and eliminating costs to fund investments in sales, branding, talent and automation to fuel future growth. The board has actively monitored the many changes being undertaken and the progress in executing the plan. In late 2019 that involved significant decisions like headcount reductions and the exit from certain content-related work as we seek to | free up funds for reinvestment and In February 2020, the board spent a week at Cognizant’s facilities in India, home to two-thirds of its associates. India is the delivery engine for many of the |

2018 Proxy Statement

To Our Stockholders:

You are invited to attend the 2018 Annual Meeting of Stockholders (the “Annual Meeting”) of Cognizant Technology Solutions Corporation (“Cognizant” or the “Company”). This notice includes important information about the meeting.

Agendacompany’s services worldwide. Since the world began to be impacted by the COVID-19 pandemic in early 2020, the board has received frequent updates on the impact to Cognizant’s employees, operations and clients and reviewed with management the various measures being undertaken to protect people’s health and maintain continuity of service for clients.

Shareholder Engagement

Executive Compensation In parallel with the refinement of our strategy, the compensation committee undertook a reevaluation of the company’s executive compensation program with the goal of ensuring that it was well aligned with the refined strategy as well as market practices and shareholder preferences. For 2020, significant changes in the program have been implemented, including a greater emphasis on revenue growth and, for the performance-based equity compensation, the inclusion of a relative total shareholder return metric and a shift to a 3-year performance period. Seepages 34 to38. | Board Composition Since last year’s annual meeting, we have welcomed three highly qualified female directors who expand the cognitive diversity of our board and, among other things, bring deep expertise in finance, technology, large professional services organizations and India-based businesses: Sandra S. During the same period, three long-serving directors who made great contributions to the board and the company retired: Francisco D’Souza, a co-founder of the company and its highly successful CEO from 2007 until 2019; John Klein, a director since 1998 and my predecessor as chairman of the board from 2003 until 2018; and Jonathan Chadwick, __________________ On behalf of my fellow board members, we welcome you to attend the |  | shareholders and thank you for your continued support.

| ||

|  |

| |||

|  |

| |||

|  |

| |||

|  |

| |||

|  |

| |||

|  |

| |||

Stockholders also will transact such other business as may properly come before the Annual Meeting.

Logistics

How To Vote

Your vote is very important. You may vote using any one of the following methods:

| |

| |

| |

|

Q&A

Who can vote at the Annual Meeting?Stockholders as of our record date, April 9, 2018.

How many shares are entitled to vote?585,898,388 shares of common stock.

May I change my vote?Yes, by delivering a new proxy with a later date, revoking your proxy, or voting in person at the Annual Meeting.

How many votes do I get?One vote on each proposal for each share you held as of April 9, 2018.

Where can I find more information?See “Additional Information” on page 61.

|

By Order of the Board of Directors,

Matthew W. FriedrichSecretaryTeaneck, New JerseyApril 20, 2018

Cognizant Technology Solutions Corporation

CORPORATE GOVERNANCE

|

| |||

|  | ||

Director Nominees

|

|  |

|

|

|

| ||||||

| ||||||||||||

|

|  |

| |||||||||

|

| |||||||||||

| ||||||||||||

|

|  |

|

|

| |||||||

|

| |||||||||||

|

|  |

|

| ||||||||

| ||||||||||||

|  |

| ||||||||||

|

|  |

| |||||||||

| ||||||||||||

|

|  |

|

| ||||||||

| ||||||||||||

|

|  |

| |||||||||

| ||||||||||||

|

|  |

|

| ||||||||

| ||||||||||||

|  |

| ||||||||||

|  |

|  | |||||||||

| ||||||||||||

|  |  |  |  |  |

2018 Proxy Statement2020 PROXY STATEMENT 1

Proxy Statement SummaryNotice of 2020 Annual Meeting

Director Nominee Experience

|

|  |

|  |

|

|  |  | |||

|

|  |

|  |

|

|  |  |

|

| |

Date      |     |  |

Time | ||

|

|

|

Online check-in begins: 9:15 a.m. Eastern Time Meeting begins: 9:30 a.m. Eastern Time | ||

Place | Via live webcast – please visitwww.virtualshare holdermeeting. com/CTSH2020 | |

| As in 2019, the 2020 annual meeting will be a virtual meeting of shareholders conducted via a live webcast that provides shareholders the same rights and opportunities to participate as they would have at an in-person meeting. We believe that a virtual meeting provides expanded shareholder access and participation and improved communications. During the virtual meeting, you may ask questions and will be able to vote your shares electronically. To participate in the annual meeting and access the list of shareholders, you will need the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card. Online check-in will begin at 9:15 a.m. Eastern Time. | ||

| Your vote is very important. You may vote using any of the following methods. | ||

| Use the Internet Vote over the Internet atwww.proxyvote.com. |

| Call Vote by telephone by calling +1-800-690-6903. |

| Mail Your Proxy Card Vote by signing, dating and returning the proxy card. |

| You are invited to participate in Cognizant’s 2020 annual meeting. If you were a shareholder at the close of business on April 6, 2020, you are entitled to vote at the annual meeting. The agenda for the meeting and the board’s recommendation with respect to each agenda item are set out below. Even if you plan to attend, we encourage you to submit your vote as soon as possible through one of the methods below.  MATTHEW W. FRIEDRICH Secretary |

Agenda | |||||

| 1 | Elect the following eleven directors to serve until the 2021 annual meeting of |  | FOReach director nominee. See page 10 ► | ||

Zein Abdalla Vinita Bali Maureen Breakiron-Evans Archana Deskus John M. Dineen John N. Fox, Jr. | Brian Humphries Leo S. Mackay, Jr. Michael Patsalos-Fox Joseph M. Velli Sandra S. Wijnberg | ||||

| 2 | Approve, on an advisory (non-binding) basis, the compensation of the company’s named executive officers. |  | See page 33 ► | ||

| 3 |  | FORthis proposal. | |||

| 4 | Consider a shareholder proposal requesting that the board of directors take action as necessary to permit shareholder action by written consent (if properly presented). |  | this proposal. See page 60 ► | ||

Q&A | ||

Who can vote at the annual meeting? Shareholders as of our record date, April 6, 2020. How many shares are entitled to vote? 541,055,494 shares of common stock. May I change my vote? Yes, by delivering a new proxy with a later date, revoking your proxy, or voting at the annual meeting. | How many votes do I get? One vote on each proposal for each share you held as of April 6, 2020. Where can I find more information? See “Additional Information” onpage 62. | |

2 Cognizant Technology Solutions CorporationCOGNIZANT

Proxy Statement SummaryAbout Cognizant

COMPENSATIONWho We Are

Cognizant is one of the world’s leading professional services companies, helping clients become data-enabled and data-driven in the digital era. Our industry-based, consultative approach helps companies evolve into modern businesses. By leading clients in leveraging technologies essential to modern enterprises, such as artificial intelligence (AI) and analytics, digital engineering, cloud and Internet of Things (IoT), we enable new business and operating models that unlock new value in markets around the world. Cognizant’s unwavering focus on our clients is led by our over 290,000 associates, who deliver services and solutions tailored to specific industries and the unique needs of the organizations we serve. |

| |||

|  | ||

Executive Compensation Program Highlights

Key Program Features

|  |  |  | ||||

|  |  |  | ||||

|  |  |  | ||||

|  |  |  | ||||

|  |  |  | ||||

|  | ||||||

OUR | We engineer modern businesses to improve everyday life |

OUR | To become the pre-eminent technology services partner to the Global 2000 C-Suite |

The Value We Create

| |

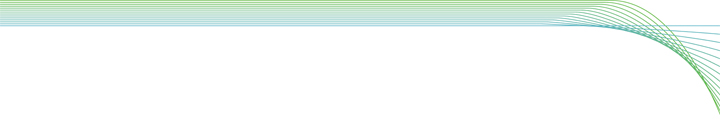

| REVENUE1 (in billions) | DILUTED EARNINGS PER SHARE1 |

|  |

| OPERATING MARGIN1 | CASH FLOW1 (in billions) |

|  |

| 1 | Constant currency revenue growth (“CC”), adjusted operating margin, adjusted diluted earnings per share and free cash flow are not measurements of financial performance prepared in accordance with GAAP. See “Non-GAAP Financial Measures” onpage 66for more information and, where applicable, reconciliations to the |   |

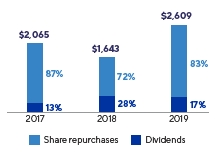

CAPITAL RETURN

(in millions)

returned to our shareholders throughshare repurchasesanddividendsin 2017, 2018 and 2019

(in millions)

invested inacquisitionsin 2017, 2018 and 2019

2018 Proxy Statement2020 PROXY STATEMENT 3

Proxy Statement Summary

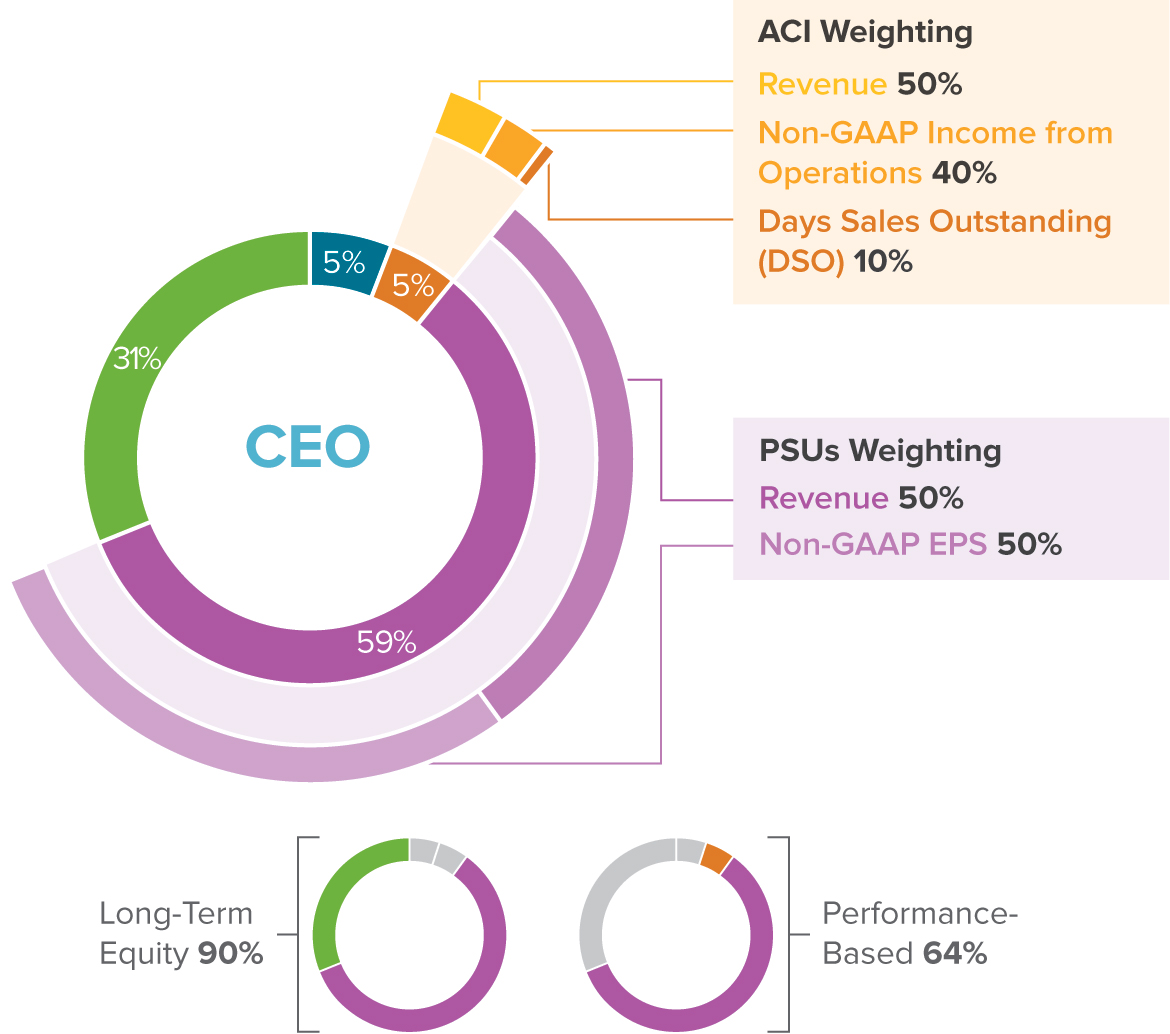

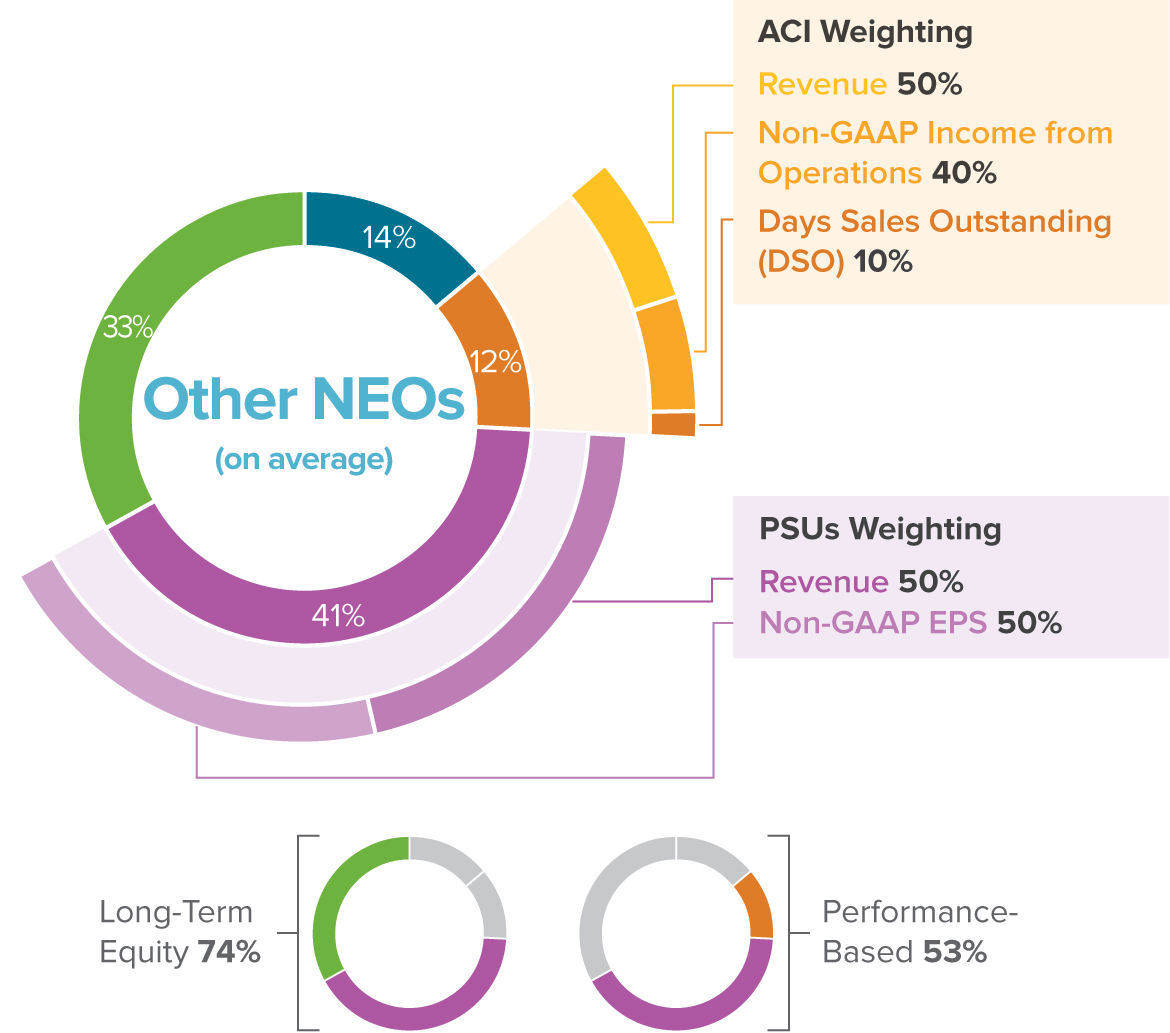

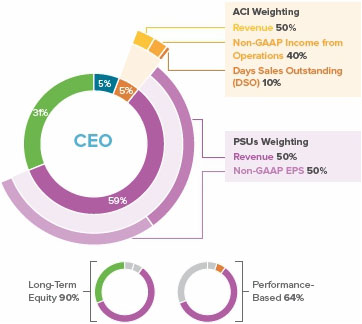

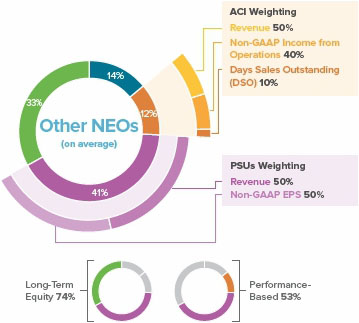

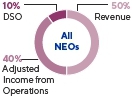

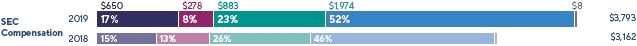

The Compensation Committee makes decisions on executive compensation from a total direct compensation perspective. Each element is considered by the committee in meeting one or more compensation program objectives. The following chart illustrates the balance of elements of 2017 target total direct compensation for our CEO and other NEOs, as described in this proxy statement.

|

|

| ||||

| ||||

| ||||

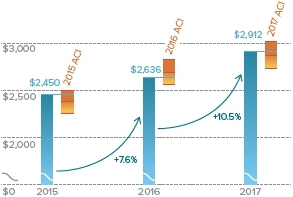

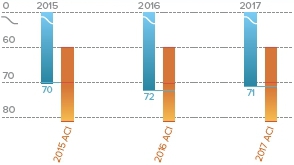

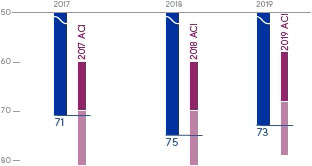

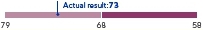

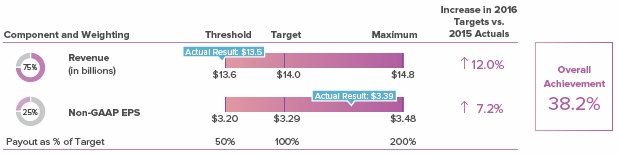

Historical ACI award achievements by year | ||

| 2015 | 2016 | 2017 |

| 142.0% | 79.8% | 114.8% |

| ||

| ||

Audit Committee | ||

Compensation Committee | ||

Finance Committee |  | |

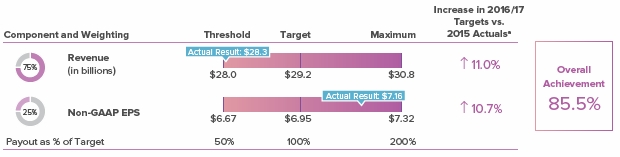

Historical PSU achievements by performance measurement period | ||

| 20151 | 20162 | 2016/172 |

| 122.9% | 38.2% | 85.5% |

| ||

| ||

| Committee Chair | |

|

|

|

|

Note: The above presentation seeks to provide a view of 2017 total direct compensation as reviewed by the Compensation Committee. As such, it uses grant date share prices for RSUs and PSUs and the target level of achievement for the ACI and PSUs. The above presentation excludes additional grants of RSUs and PSUs to Mr. Mehta and Mr. Chintamaneni made in connection with the expansion of their roles in 2016 and the signing bonus and grants of RSUs and PSUs to Mr. Friedrich upon his joining the Company in 2017.

4 Cognizant Technology Solutions CorporationCOGNIZANT

Proxy Statement Summary

2017 Target Direct Compensation of Our Named Executive Officers

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

|

| ||||||||||

2017 Compensation(in thousands)

| Name and Principal Position | Year | Salary | Cash Bonus | Annual Cash Incentive | PSU | RSU | All Other Pension and Deferred Comp. | All Other Comp. | SEC Total | Adjusted SEC Total | 1 | ||||||||||||||||||||

| Francisco D’Souza CEO | 2017 | $ | 669 | — | $ | 648 | $ | 7,220 | $ | 3,774 | — | $ | 167 | $ | 12,478 | $ | 12,478 | ||||||||||||||

| 2016 | $ | 664 | — | $ | 450 | $ | 7,019 | — | 1 | — | $ | 123 | $ | 8,257 | $ | 12,031 | |||||||||||||||

| Rajeev Mehta President | 2017 | $ | 630 | — | $ | 615 | $ | 4,604 | $ | 2,545 | — | $ | 56 | $ | 8,450 | $ | 8,450 | ||||||||||||||

| 2016 | $ | 574 | — | $ | 389 | $ | 3,584 | — | 1 | — | $ | 6 | $ | 4,554 | $ | 7,099 | |||||||||||||||

| Karen McLoughlin CFO | 2017 | $ | 500 | — | $ | 488 | $ | 1,967 | $ | 1,038 | — | $ | 8 | $ | 4,001 | $ | 4,001 | ||||||||||||||

| 2016 | $ | 427 | — | $ | 289 | $ | 1,876 | — | 1 | — | $ | 8 | $ | 2,599 | $ | 3,638 | |||||||||||||||

| Ramakrishna Prasad Chintamaneni EVP and President, Global Industries and Consulting | 2017 | $ | 475 | — | $ | 463 | $ | 1,042 | $ | 1,897 | — | $ | 8 | $ | 3,885 | $ | 3,885 | ||||||||||||||

| 2016 | $ | 417 | $ | 566 | — | $ | 831 | $ | 1,615 | — | $ | 8 | $ | 3,437 | $ | 3,437 | |||||||||||||||

| Matthew W. Friedrich EVP, General Counsel, Chief Corporate Affairs Officer and Secretary | 2017 | 2 | $ | 330 | $ | 500 | $ | 512 | $ | 1,252 | $ | 4,257 | — | $ | 132 | $ | 6,983 | $ | 6,983 | ||||||||||||

| |

|

2018 Proxy Statement 5

Proxy Statement Summary

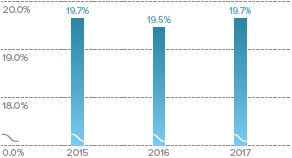

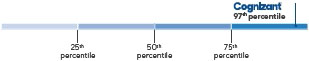

Aligning Pay with Performance

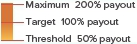

The following graphs show Company performance across revenue, profitability and cash flow metrics for the last three years as compared to the performance targets for the annual cash incentives (ACIs) and PSUs with performance measurement periods covering such years. In addition, the Company’s share price performance, which impacts the performance of long-term equity grants and holdings of our common stock, is set forth below for the last five years.

|

(in billions)

|

|

|

| Target Increase2 | Weighting | Payout Range | |||||

| 2015 ACI | 19.0% | 50% |  | ||||

| 2016 ACI | 11.0% | 50% | |||||

| 2017 ACI | 9.0% | 50% | |||||

| 2015 PSUs | 19.1% | 100% |  | ||||

| 2016 PSUs | 12.0% | 75% | |||||

| 2016/17 PSUs | 11.0% | 75% |

| |

|

|

| |

|

|

(in millions)

|

| Target Increase2 | Weighting | Payout Range | |||||

| 2015 ACI | 14.8% | 40% |  | ||||

| 2016 ACI | 9.8% | 40% | |||||

| 2017 ACI | 8.9% | 40% |

|

| |

| |

| |

|

6 Cognizant Technology Solutions Corporation

Proxy Statement Summary

| |

|

| Target Increase3 | Weighting | Payout Range | |||||

| 2015 PSUs | — | — |  | ||||

| 2016 PSUs | 10.4% | 25% | |||||

| 2016/17 PSUs | 10.7% | 25% |

| |

| |

|

| |

| |

|

| Leadership |  | Security |  | Public Company Governance | |||

| Technology and Consulting Services |  | Regulated Industries |   | International Business Development | ||

| Talent Management |  | |||||

|

| |

| |

|

2018 Proxy Statement2020 PROXY STATEMENT 7

Proxy Statement Summary

AUDIT

|

| |||

|  | ||

ADDITIONAL PROPOSALS

Company Proposals

|

| |||

|  | ||

|

| |||

|  | ||

8 Cognizant Technology Solutions Corporation

Proxy Statement Summary

Stockholder Proposals

|

|  | |||

|

|  | |||

2018 Proxy Statement 9

|

Director Nominees

|  | |||

|  | |||

|  |  |  |  |  |

10 Cognizant Technology Solutions Corporation

|  | |||

|  | |||

|  | |||

|  |  |  |  |  |

2018 Proxy Statement 11

|  | |||

|  | |||

|  | |||

|  |  |  |  |  |

12 Cognizant Technology Solutions Corporation

|  | |||

|  | |||

|  | |||

|  |  |  |  |  |

2018 Proxy Statement 13

Board Composition and Refreshment

Director Independence

Board Member Independence

|  |  |  | ||

Determine Desired Director Qualifications In order to build an independent board with broad and diverse experience and judgment that is committed to representing the long-term interests of our | |||||

| RELEVANT SKILLS AND EXPERIENCE | … for a Fortune 200 public company, a global professional services and technology company and the company’s strategy Seepages 8 and9. | ||||

| DIRECTOR DIVERSITY | … including as to race, gender, age, national origin and cultural background ●Our board has committed to include women and persons with ethnically or racially diverse backgrounds in each pool of candidates from which we select new director nominees ●The board evaluates the effectiveness of its director diversity efforts through its annual self-evaluation process and on an ongoing basis through its director candidate search processes led by the | ||||

| DIRECTOR INDEPENDENCE | … and avoiding conflicts of interest ●Our board considers other positions a director or a director candidate has held or holds (including other board memberships) and any potential conflicts of interest to ●There are no family relationships among any of our ●Our board determines independence in accordance with the rules of The Nasdaq Stock Market LLC (“Nasdaq”). Board Member Independence.Each of our director nominees, other than our current CEO, Mr. Humphries, as well as each of the individuals who retired as a director since our 2019 annual meeting (other than our former CEO, Francisco D’Souza), has been determined by the board to be an “independent director” under the rules of Nasdaq, which require that, in the opinion of the | ||||

director.

| The | ||||

| ATTENTION AND FOCUS | … by each director in light of other obligations Our corporate governance guidelines provide that directors are: ●Required to offer to resign from the board following a material change in job responsibilities (other than retirement) ●Limited to service on no more than four other public company boards (two if the director is a public company CEO) | ||||

| BALANCE OF TENURES | … between knowledge of the company and fresh perspectives and insights  | ||||

| ||

Identify Candidates GOVERNANCE COMMITTEE SEARCH ●The Governance Committee develops criteria for any search process, including any specific desired skills, experiences, characteristics or qualifications ●A subset of directors may be tasked by the committee with leading a search process ●The committee typically engages an independent director search firm Recent Director Appointments The three director nominees appointed to the board since the 2019 annual meeting (Vinita Bali, Archana Deskus and Sandra Wijnberg) were each identified and evaluated through a director search process overseen by the Governance Committee and undertaken with the assistance of an independent director search firm. | ||

SHAREHOLDER RECOMMENDATIONS Shareholders may recommend candidates to the Governance Committee by sending to the company’s secretary: ●The name(s) of the proposed director candidates ●Appropriate biographical information and background materials ●A statement as to whether the shareholder or group of shareholders making the recommendation has beneficially owned more than 5% of the company’s common stock for at least one year | ||

INTERNAL RECOMMENDATIONS Independent directors, management and others may recommend potential candidates | ||

6 COGNIZANT

|  |  | ||

| Board Recommends Director Nominees | ||||

GOVERNANCE COMMITTEERECOMMENDATION PROCESS | ||||

Discuss, assess and interview candidates | ||||

| ||||

Evaluate candidates based on desired characteristics and skills | ||||

| ||||

Recommend nominees to the board | ||||

| ||||

BOARD NOMINATION PROCESS | ||||

Interview, discuss and assess nominees recommended by the Governance Committee | ||||

| ||||

Analyze independence | ||||

| ||||

Appoint directors to the board | ||||

| ||||

Recommend nominees for shareholder vote at next annual meeting | ||||

Process is substantially the same for any shareholder-proposed candidates | ||||

|  |  |  | ||||

Annual Shareholder Vote SHAREHOLDERS VOTE ON NOMINEES AT ANNUAL MEETING All directors are elected annually and subject to a majority voting standard Majority Voting Standard Our by-laws provide that the voting standard for the election of directors in uncontested elections is a majority of votes cast. Any director who does not receive a majority of the votes cast for his or her election must tender an irrevocable resignation that will become effective upon acceptance by the board. The Governance Committee will recommend to the board whether to accept the director’s resignation within 90 days following the certification of the shareholder vote. The board will promptly disclose whether it has accepted or rejected the director’s resignation, and the reasons for its decision, in a Current Report on Form 8-K. The Governance Committee and the board may consider any factors they deem relevant in deciding whether to accept a director’s resignation. Our corporate governance guidelines contain additional specifics regarding our director resignation policy. See “Helpful Resources” onpage 69. | Annual Board Self-Evaluation EVALUATION OF BOARD AND COMMITTEE EFFECTIVENESS In 2019, the board and each of its committees undertook a self-evaluation process with the assistance of a third party that conducted a series of interviews with each of our directors and certain members of management to gather input on individual director’s contributions, the effectiveness of the board and committee compositions and structure and the communication and reporting processes between management and the board. The third party reported its findings to the board, and provided feedback to individual directors and members of management. Feedback from the 2019 board self-evaluation has driven several changes in board operations in 2020, including: ●The format and timing of board agendas and materials; and ●The format and content of the director onboarding process. | ||||||

| |||||||

Shareholder Nominees | ||||

PROXY ACCESS | ||||

3% for 3 years | One or more shareholders holding at least 3% of the company’s common stock for at least 3 years may submit director nominees for inclusion in the company’s proxy statement. | |||

25% | of the | Shareholder-submitted nominees may be submitted via proxy access for up to 25% of the board or 2 directors, whichever is greater. | ||

Shareholder-submitted proxy access nominees that satisfy the requirements in the company’s by-laws are included in the company’s proxy statement. See “Director Nominees Via Proxy Access” onpage 61. | ||||

2020 PROXY STATEMENT 7

8 COGNIZANT

| PUBLIC COMPANY LEADERSHIP |  |

Directors who have served in a CEO, president or senior executive business role directing strategy and management at a large publicly-traded company or significant business unit of such a company bring valuable practical experience and understanding to the boardroom that is highly relevant to a large, global organization such as Cognizant. This includes experience addressing the challenges of large-scale operations and experience identifying and developing leadership qualities for the management team that takes on such challenges.

| TECHNOLOGY AND CONSULTING SERVICES |  |

As a global professional services organization focused on providing technology and consulting services to many of the world’s leading companies, we benefit from having a number of directors who have extensive experience in senior leadership roles at companies in the technology and consulting fields.

| TALENT MANAGEMENT |  |

As a global professional services organization, our people are our most important asset and the successful development and retention of our professionals is critical to our success. As such, we benefit from having directors with a deep understanding of the dynamics of a people-based business obtained from experience as a senior leader in a large, international professional services organization.

| SECURITY |  |

Our business is critically dependent on our ability to maintain the confidentiality of sensitive business and personal data of our clients and our clients’ customers, in addition to our own such data. Having directors with expertise in information security is important to our business and our risk management strategy.

| REGULATED INDUSTRIES |  |

We are highly dependent on customers concentrated in certain regulated industries such as financial services and healthcare. Directors with particular knowledge of these industries are beneficial to the board’s understanding of the unique challenges faced by clients in these industries and oversight of the company’s strategy and regulatory compliance.

| OPERATIONS MANAGEMENT |  |

As we pursue continued growth and increased profitability for our business, having directors who have experience serving as a chief operating officer or similar position with operational oversight of a large organization provides valuable administrative and operational insights at the board level.

| PUBLIC COMPANY GOVERNANCE |  |

We believe that having directors who currently serve on the boards of other U.S.-listed public companies is important to Cognizant maintaining good corporate governance practices as such directors are able to provide insight into current U.S. public company board practices, including with respect to board management, relations between the board and senior management, board refreshment, management succession planning, risk management and executive compensation.

| INTERNATIONAL BUSINESS DEVELOPMENT |  |

We are continually focused on growing our business, including through acquisitions and geographic expansion. Directors who have experience overseeing corporate strategy and development or managing large non-U.S. organizations provide valuable insight into the challenges and risks, as well as the means of successfully overcoming such challenges and risks, with respect to acquiring and integrating other companies and undertaking continued international expansion of our business.

| FINANCE, ACCOUNTING AND RISK MANAGEMENT |  |

As a large, publicly-traded company with a global footprint, we benefit from directors with financial accounting and reporting, regulatory compliance and risk management experience derived from serving in roles such as CFO, head of internal audit or chief risk officer of a large, global, publicly-traded company or as an audit partner at a public accounting firm.

In many instances other directors not appearing under a particular category may also have a significant level of experience in the area, as may be evident from their biographies, but were not included above due to this presentation’s focus on only those directors with the most significant levels of experience and expertise in the respective areas.

2020 PROXY STATEMENT 9

|

Weighted Average Attendance of | |||||||

| 98% | 98% | 91% | |||||

| B | Board of Directors | A | Audit Committee | F | Finance Committee | ||

| 100% | 97% | ||||||

| G | Governance Committee | C | Compensation Committee | ||||

Our corporate governance guidelines provide that directors are expected to attend the annual meeting of shareholders. For the 2019 annual meeting, Mr. Humphries acted as chairman and all of the other 10 then-current directors attended by teleconference. |

Zein Abdalla Former President of PepsiCo |  | ||

| Director Since2015 Age61 Independent | Committees | Birthplace | |

Key Qualifications  Decades of experience leading and shaping large scale operations across the world at PepsiCo (PEP), a Fortune 50, Nasdaq-listed multinational food, snack and beverage company, through various senior executive roles, most recently as President. Decades of experience leading and shaping large scale operations across the world at PepsiCo (PEP), a Fortune 50, Nasdaq-listed multinational food, snack and beverage company, through various senior executive roles, most recently as President. Extensive global operations management experience having served as CEO of PepsiCo Europe and as a manager to several international business lines prior to that, including as General Manager of PepsiCo’s European Beverage Business and Franchise VP for Pakistan and the Gulf Region. Extensive global operations management experience having served as CEO of PepsiCo Europe and as a manager to several international business lines prior to that, including as General Manager of PepsiCo’s European Beverage Business and Franchise VP for Pakistan and the Gulf Region. Serves on the board of The TJX Companies (TJX), a retailer of apparel and home fashions (since 2012). Serves on the board of The TJX Companies (TJX), a retailer of apparel and home fashions (since 2012). Global strategic insight having led and shaped large scale operations across the world throughout his career at PepsiCo in his roles as President and as a senior executive responsible for Europe and the Gulf Region. Global strategic insight having led and shaped large scale operations across the world throughout his career at PepsiCo in his roles as President and as a senior executive responsible for Europe and the Gulf Region. |

Career Highlights ●President of PepsiCo, Inc. (PEP), a multinational food, snack and beverage company (2012 – 2014) ●Executive positions with PepsiCo Europe Region –Chief Executive Officer (2009 – 2012) –President (2006 – 2009) –Various senior positions with PepsiCo (1995 – 2006) Current Public Company Boards ●The TJX Companies, Inc. (TJX), a retailer of apparel and home fashions (since 2012) Select Other Positions ●Board member of Mastercard Foundation (since 2017) ●Board member of Kuwait Food Company K.S.C.P. (since 2017) ●Member of the Imperial College Business School Advisory Board (since 2016) ●Board Advisor, Mars, Incorporated (since 2016) |

Education ●B.S., Imperial College, London University |

| Key | Committees | |||

| A | Audit | C | Compensation Committee | |

| F | Finance Committee | G | Governance Committee | |

| CHAIR | Committee Chair | + | Audit Committee Financial Expert | |

10 COGNIZANT

| Vinita Bali | Maureen Breakiron-Evans | |||||||

| Former CEO and Managing Director of Britannia Industries and Former VP, Coca-Cola |  | Former CFO of Towers Perrin |  | |||||

| Director Since 2020 Age64 Independent | Birthplace India  | Director Since 2009 Age65 Independent | Committees | Birthplace USA  | ||||

Key Qualifications  Experience directing and shaping strategy for international, publicly-listed corporations, including as CEO of India-based Britannia Industries, listed on the National Stock Exchange and Bombay Stock Exchange in India, and as VP and Head, Corporate Strategy of Coca-Cola (KO). Experience directing and shaping strategy for international, publicly-listed corporations, including as CEO of India-based Britannia Industries, listed on the National Stock Exchange and Bombay Stock Exchange in India, and as VP and Head, Corporate Strategy of Coca-Cola (KO). Global operations management experience having led key divisions around the globe for Coca-Cola and Cadbury Schweppes, including as President, Andean Division for Coca-Cola and as a board member for Cadbury’s Nigeria and South Africa operations. Global operations management experience having led key divisions around the globe for Coca-Cola and Cadbury Schweppes, including as President, Andean Division for Coca-Cola and as a board member for Cadbury’s Nigeria and South Africa operations. Serves on the boards of Bunge (BG), an agribusiness and food company (since 2018), and Smith & Nephew (SNN), a global portfolio medical technology business (since 2014). Serves on the boards of Bunge (BG), an agribusiness and food company (since 2018), and Smith & Nephew (SNN), a global portfolio medical technology business (since 2014). Extensive experience leading large multinational corporations gained through her tenure as CEO of India-based Britannia Industries and through over two decades serving in senior business and marketing roles around the globe for Coca-Cola and Cadbury Schweppes. Extensive experience leading large multinational corporations gained through her tenure as CEO of India-based Britannia Industries and through over two decades serving in senior business and marketing roles around the globe for Coca-Cola and Cadbury Schweppes. | Key Qualifications  Insight into the particular financial and operational challenges of a business like Cognizant where talent is a key asset gained through her role as CFO of Towers Perrin, a global professional services company. Insight into the particular financial and operational challenges of a business like Cognizant where talent is a key asset gained through her role as CFO of Towers Perrin, a global professional services company. Expertise in information security matters across diverse industries, having overseen the information security function in her roles as EVP and CFO of Inovant (part of Visa (V)) and as VP of Control and Services and President of Transamerica Business Technologies, part of Transamerica, a financial services company. Expertise in information security matters across diverse industries, having overseen the information security function in her roles as EVP and CFO of Inovant (part of Visa (V)) and as VP of Control and Services and President of Transamerica Business Technologies, part of Transamerica, a financial services company. Expertise in both the healthcare and financial services sectors, having served as VP and General Auditor for CIGNA (CI), a health insurance services company, and in senior leadership roles at Inovant and Transamerica, along with board service at several banks: Ally Financial (ALLY), Federal Home Loan Bank of Pittsburgh and ING Direct. Expertise in both the healthcare and financial services sectors, having served as VP and General Auditor for CIGNA (CI), a health insurance services company, and in senior leadership roles at Inovant and Transamerica, along with board service at several banks: Ally Financial (ALLY), Federal Home Loan Bank of Pittsburgh and ING Direct. Serves on the boards of Ally Financial, an internet bank (since 2015), and Cubic (CUB), a provider of systems and services to transportation and defense markets worldwide (since 2017). Serves on the boards of Ally Financial, an internet bank (since 2015), and Cubic (CUB), a provider of systems and services to transportation and defense markets worldwide (since 2017). Accounting and auditing experience across diverse industries gained through her roles as CFO of Towers Perrin, VP and General Auditor of CIGNA, EVP and CFO of Inovant and as a partner at Arthur Andersen. Accounting and auditing experience across diverse industries gained through her roles as CFO of Towers Perrin, VP and General Auditor of CIGNA, EVP and CFO of Inovant and as a partner at Arthur Andersen. |

Career Highlights ●Chief Executive Officer and Managing Director, Britannia Industries, an India-based food company (2005 – 2014) ●Managing Principal and Head of Business Strategy Practice, USA, The Zyman Group (2003 – 2005) ●Executive-level business and marketing leadership roles at The Coca-Cola Company (KO), based in the United States and Chile (1994 – 2003) –Vice President and Head, Corporate Strategy –President, Andean Division –Worldwide Marketing Director ●Senior marketing roles at Cadbury Schweppes Plc across a number of geographies, including South Africa, Nigeria, India and the U.K. (1990 - 1994) Current Public Company Boards ●Bunge Ltd. (BG), an agribusiness and food company (since 2018) ●Smith & Nephew Plc (SNN), a global portfolio medical technology business (since 2014) ●Syngene International Ltd., a research and manufacturing company listed on the National Stock Exchange (“NSE”) and Bombay Stock Exchange (“BSE”) in India (since 2017) ●CRISIL Ltd., a global analytical company providing ratings, research and risk and policy advisory services listed on the NSE and BSE (since 2014) Select Other Positions ●Member of the Board of Governors of the Indian Institute of Management (Bangalore) | Career Highlights ●Chief Financial Officer of Towers Perrin, a global professional services company (2007 – 2008) ●Vice President and General Auditor of CIGNA Corporation (CI), a health insurance services company (2005 – 2006) ●Executive Vice President and Chief Financial Officer of Inovant, LLC, the captive technology development and transaction processing company of Visa, Inc. (V) (2001 – 2004) ●Various executive positions with Transamerica Corp., a financial services company (1994 – 1999) ●16 years in public accounting, ultimately as a partner at Arthur Andersen LLP through 1994 Current Public Company Boards ●Ally Financial Inc. (ALLY), an Internet bank (since 2015) ●Cubic Corporation (CUB), a provider of systems and services to transportation and defense markets worldwide (since 2017) Select Past Director Positions ●Federal Home Loan Bank of Pittsburgh, a private government-sponsored enterprise (2011 – 2014) ●Heartland Payment Systems, Inc., a provider of payment processing services (2012 – 2016) ●ING Direct, an Internet bank (2007 – 2008) |

Education ●B.A., University of Delhi, India ●M.B.A., Jamnalal Bajaj Institute of Management Studies in India | Education ●B.B.A., Stetson University ●M.B.A., Harvard Business School ●M.L.A., Stanford University | Certifications ●CPA in Florida ●Carnegie Mellon University NACD certificate in cybersecurity |

| Key Qualifications | |||||||

| Public Company Leadership |  | Security |  | Public Company Governance | ||

| Technology and Consulting Services |  | Regulated Industries |  | International Business Development | ||

| Talent Management |  | Operations Management |  | Finance, Accounting and Risk Management | ||

2020 PROXY STATEMENT 11

| Archana Deskus | John M. Dineen | |||||||

| Chief Information Officer of Intel |  | Former President and CEO of GE Healthcare |  | |||||

| Director Since 2020 Age54 Independent | Birthplace USA  | Director Since 2017 Age57 Independent | Committees | Birthplace USA  | ||||

Key Qualifications  Extensive experience as a senior leader of large, global technology companies gained through her CIO roles at companies including Intel (INTC), Hewlett-Packard Enterprise (HPE), Baker Hughes, Ingersoll Rand (IR), Timex and North American HVAC (part of Carrier Corporation (CARR)). Extensive experience as a senior leader of large, global technology companies gained through her CIO roles at companies including Intel (INTC), Hewlett-Packard Enterprise (HPE), Baker Hughes, Ingersoll Rand (IR), Timex and North American HVAC (part of Carrier Corporation (CARR)). Broad expertise across diverse industries in the information security space gained through her CIO roles at global companies in the technology, industrials, energy and consumer products industries, including Intel, Hewlett-Packard Enterprise, Baker Hughes, Ingersoll Rand, Timex and North America HVAC. Broad expertise across diverse industries in the information security space gained through her CIO roles at global companies in the technology, industrials, energy and consumer products industries, including Intel, Hewlett-Packard Enterprise, Baker Hughes, Ingersoll Rand, Timex and North America HVAC. Serves on the board of East West Bancorp (EWBC), the holding company for East West Bank, the largest independent bank in Southern California (since 2019). Serves on the board of East West Bancorp (EWBC), the holding company for East West Bank, the largest independent bank in Southern California (since 2019). Extensive experience setting and leading technology strategy for large, global companies as CIO for Intel, Hewlett-Packard Enterprise, Baker Hughes, Ingersoll Rand, Timex and North America HVAC. Extensive experience setting and leading technology strategy for large, global companies as CIO for Intel, Hewlett-Packard Enterprise, Baker Hughes, Ingersoll Rand, Timex and North America HVAC. | Key Qualifications  Broad-based experience managing several key business divisions of General Electric (GE), at the time a Fortune 20, NYSE-listed, global digital industrial company. Most recently, he was President and CEO of London-based GE Healthcare, a then $18 billion annual revenue enterprise with over 50,000 employees around the world. He was previously CEO of GE Transportation and President of GE Plastics. Broad-based experience managing several key business divisions of General Electric (GE), at the time a Fortune 20, NYSE-listed, global digital industrial company. Most recently, he was President and CEO of London-based GE Healthcare, a then $18 billion annual revenue enterprise with over 50,000 employees around the world. He was previously CEO of GE Transportation and President of GE Plastics. Expertise in the healthcare sector, having served as President and CEO of GE Healthcare, a leading provider of medical imaging, diagnostics and other health information technology. Expertise in the healthcare sector, having served as President and CEO of GE Healthcare, a leading provider of medical imaging, diagnostics and other health information technology. Diverse operating experience in healthcare, several other key industries and various geographies we serve from his background in operating executive roles at General Electric, including as President and CEO of GE Healthcare, CEO of GE Transportation and President of GE Plastics. Diverse operating experience in healthcare, several other key industries and various geographies we serve from his background in operating executive roles at General Electric, including as President and CEO of GE Healthcare, CEO of GE Transportation and President of GE Plastics. Serves on the board of Syneos Health (SYNH), a biopharmaceutical solutions organization (since 2018). Serves on the board of Syneos Health (SYNH), a biopharmaceutical solutions organization (since 2018). Valuable global expansion insight from having helped strengthen General Electric’s international reach during his 28 years in leadership roles in several GE industries around the world, including as President and CEO of London-based GE Healthcare and several international management roles based in Asia and Europe. Valuable global expansion insight from having helped strengthen General Electric’s international reach during his 28 years in leadership roles in several GE industries around the world, including as President and CEO of London-based GE Healthcare and several international management roles based in Asia and Europe. |

Career Highlights ●Senior Vice President, Chief Information Officer, Intel Corporation (INTC), a technology company (since January 2020) ●Senior Vice President, Chief Information Officer, Hewlett-Packard Enterprise Company (HPE), an information technology company (2017 – 2020) ●Vice President, Chief Information Officer, Baker Hughes Incorporated, an oilfield services company acquired by General Electric in 2017 (2013 – 2017) ●Vice President, Chief Information Officer, Ingersoll Rand Inc. (IR), an industrial manufacturing company (2011 – 2012) ●Vice President, Chief Information Officer, Timex Group USA, Inc., a watch manufacturing company (2006 – 2011) ●Vice President, Chief Information Officer, North America HVAC, Carrier Corporation (CARR), a heating, air-conditioning and refrigeration solutions company (2003 – 2006) Current Public Company Boards ●East West Bancorp, Inc. (EWBC), the holding company for East West Bank, the largest independent bank in Southern California (since 2019) –Also on the board of East West Bank Select Other Past Positions ●Customer advisory board member for IBM Global Technology Services (2016 - 2017) ●Board member for the Junior Achievement of Southeast Texas (2014 - 2017) ●Advisory board member for the Data Science Institute of the University of Houston (2018 - 2020) | Career Highlights ●Operating Advisor of Clayton, Dubilier & Rice LLC, an investment firm (since 2015) ●Executive positions with General Electric Company (GE), a global digital industrial company –President and Chief Executive Officer, GE Healthcare (2008 – 2014) –Chief Executive Officer, GE Transportation (2005 – 2008) –Other leadership positions (1986 – 2005) Current Public Company Boards ●Syneos Health, Inc. (SYNH), a biopharmaceutical solutions organization (since 2018) Select Past Director Positions ●Merrimack Pharmaceuticals, Inc. (MACK), a pharmaceutical company specializing in the development of drugs for the treatment of cancer (2015 – 2019) |

Education ●B.S., Boston University. ●M.B.A., Rensselaer Polytechnic Institute | Education ●B.S., University of Vermont |

| Key | Committees | |||

| A | Audit Committee | C | Compensation Committee | |

| F | Finance Committee | G | Governance Committee | |

| CHAIR | Committee Chair | + | Audit Committee Financial Expert | |

12 COGNIZANT

| John N. Fox, Jr. | Brian Humphries | |||||||

| Former Vice Chairman of Deloitte & Touche and Global Director, Strategic Clients of Deloitte Consulting |  | CEO of Cognizant |  | |||||

| Director Since 2007 Age77 Independent | Committees | Birthplace USA  | Director Since 2019 Age46 | Birthplace Ireland  | ||||

Key Qualifications  Over 30 years of experience serving clients as a senior executive of Deloitte Consulting, a global consulting firm, most recently as Vice Chairman of Deloitte & Touche and Global Director, Strategic Clients of Deloitte Consulting. Over 30 years of experience serving clients as a senior executive of Deloitte Consulting, a global consulting firm, most recently as Vice Chairman of Deloitte & Touche and Global Director, Strategic Clients of Deloitte Consulting. Insight into the challenges of talent management across a large professional services organization gained from his many years as a senior leader at Deloitte. Insight into the challenges of talent management across a large professional services organization gained from his many years as a senior leader at Deloitte. Insight into the cybersecurity space from having served for over a decade as a director of OneSpan (OSPN) (formerly VASCO Data Security International), a cybersecurity firm providing authentication, antifraud and e-signature services. Insight into the cybersecurity space from having served for over a decade as a director of OneSpan (OSPN) (formerly VASCO Data Security International), a cybersecurity firm providing authentication, antifraud and e-signature services. Serves on the board of OneSpan (OSPN) (since 2005). Serves on the board of OneSpan (OSPN) (since 2005). Valuable global management expertise, having served as Global Director, Strategic Clients of Deloitte Consulting. Valuable global management expertise, having served as Global Director, Strategic Clients of Deloitte Consulting. | Key Qualifications  Extensive senior leadership experience at public companies in the technology sector, having served as CEO, Vodafone Business, for Vodafone Group (VOD), one of the world’s largest telecommunications companies, and in various senior roles for leading technology companies Dell Technologies (DELL) and Hewlett-Packard (HPQ). Extensive senior leadership experience at public companies in the technology sector, having served as CEO, Vodafone Business, for Vodafone Group (VOD), one of the world’s largest telecommunications companies, and in various senior roles for leading technology companies Dell Technologies (DELL) and Hewlett-Packard (HPQ). Leadership positions at some of the world’s most well-known, international technology companies, including CEO, Vodafone Business, President and COO, Infrastructure Solutions Group and President, Global Enterprise Solutions at Dell and SVP, Emerging Markets and SVP, Strategy and Corporate Development at Hewlett-Packard. Leadership positions at some of the world’s most well-known, international technology companies, including CEO, Vodafone Business, President and COO, Infrastructure Solutions Group and President, Global Enterprise Solutions at Dell and SVP, Emerging Markets and SVP, Strategy and Corporate Development at Hewlett-Packard. Operations management experience from having served as CEO of Vodafone Business and as President and COO, Infrastructure Solutions Group for Dell. Operations management experience from having served as CEO of Vodafone Business and as President and COO, Infrastructure Solutions Group for Dell. Significant experience managing global enterprises through his executive leadership roles with Vodafone Group and Dell, where he oversaw key business divisions with geographically diverse operations, such as Vodafone Business and Dell’s Infrastructure Solutions Group and Global Enterprise Solutions, and experience developing business in emerging markets through his roles with Dell and Hewlett-Packard, including as VP and General Manager, EMEA Enterprise Solutions for Dell, and SVP, Emerging Markets for Hewlett-Packard. Significant experience managing global enterprises through his executive leadership roles with Vodafone Group and Dell, where he oversaw key business divisions with geographically diverse operations, such as Vodafone Business and Dell’s Infrastructure Solutions Group and Global Enterprise Solutions, and experience developing business in emerging markets through his roles with Dell and Hewlett-Packard, including as VP and General Manager, EMEA Enterprise Solutions for Dell, and SVP, Emerging Markets for Hewlett-Packard. |

Career Highlights ●Vice Chairman of Deloitte & Touche LLP, a global professional services firm, and Global Director, Strategic Clients of Deloitte Consulting (1998 – 2003) ●Member of Deloitte Touche Tohmatsu Board of Directors and the board’s Governance (Executive) Committee (1998 – 2003) ●Various senior positions with Deloitte Consulting (1968 – 2003) Current Public Company Boards ●OneSpan Inc. (OSPN) (formerly VASCO Data Security International, Inc.), a cybersecurity firm providing authentication, antifraud and e-signature services (since 2005) Select Other Positions ●Emeritus Trustee for Steppenwolf Theatre Company ●Trustee for Wabash College | Career Highlights ●Chief Executive Officer, Cognizant (since 2019) ●Chief Executive Officer, Vodafone Business (2017 – 2019) for Vodafone Group plc (VOD), one of the world’s largest telecommunications companies –Vodafone Business encompassed business-to-business fixed and mobile customers –Also led Vodafone’s Internet of Things (IoT) business, Cloud & Security and Carrier Services ●Executive positions at Dell Technologies Inc. (DELL), a leading technology company –President and Chief Operating Officer, Infrastructure Solutions Group (2016 – 2017) –President, Global Enterprise Solutions (2014 – 2016) –Vice President and General Manager, EMEA Enterprise Solutions (2013 – 2014) ●Senior positions at Hewlett-Packard (now HP Inc.) (HPQ), a leading technology company –Senior Vice President, Emerging Markets (2011 – 2013) –Senior Vice President, Strategy and Corporate Development (2008 – 2011) ●Various senior finance, investor relations and internal audit positions at technology companies Compaq Computer Corporation and Digital Equipment Corporation |

Education ●B.A., Wabash College ●M.B.A., University of Michigan | Education ●B.A., University of Ulster, Northern Ireland |

| Key Qualifications | |||||||

| Public Company Leadership |  | Security |  | Public Company Governance | ||

| Technology and Consulting Services |  | Regulated Industries |  | International Business Development | ||

| Talent Management |  | Operations Management |  | Finance, Accounting and Risk Management | ||

2020 PROXY STATEMENT 13

| Leo S. Mackay, Jr. | Michael Patsalos-Fox | Chairman | ||||||

| SVP, Ethics and Enterprise Assurance of Lockheed Martin |  | Former CEO of Stroz Friedberg and Former Chairman, the Americas of McKinsey & Company |  | |||||

| Director Since 2012 Age58 Independent | Committees | Birthplace USA  | Director Since 2012 Age67 Independent | Committees | Birthplace Cyprus  | |||

Key Qualifications  Technology consulting experience specific to the healthcare industry, having served as COO of ACS State Healthcare (now part of Conduent), an information technology and business process outsourcing (“IT/BPO”) services company in the healthcare space. Technology consulting experience specific to the healthcare industry, having served as COO of ACS State Healthcare (now part of Conduent), an information technology and business process outsourcing (“IT/BPO”) services company in the healthcare space. Over a decade of experience in the security sector as a senior executive for Lockheed Martin (LMT), a global security and aerospace company, where he currently serves as SVP, Ethics and Enterprise Assurance. Over a decade of experience in the security sector as a senior executive for Lockheed Martin (LMT), a global security and aerospace company, where he currently serves as SVP, Ethics and Enterprise Assurance. Expertise in the government contracting space, having served in several leadership roles at Lockheed Martin, as well as expertise in the healthcare sector, having served as COO for ACS State Healthcare. Expertise in the government contracting space, having served in several leadership roles at Lockheed Martin, as well as expertise in the healthcare sector, having served as COO for ACS State Healthcare. Operating experience from having served as Deputy Secretary and COO of the U.S. Department of Veterans Affairs and President of Integrated Coast Guard Systems, a joint venture between global security and aerospace companies Lockheed Martin and Northrop Grumman (NOC). Operating experience from having served as Deputy Secretary and COO of the U.S. Department of Veterans Affairs and President of Integrated Coast Guard Systems, a joint venture between global security and aerospace companies Lockheed Martin and Northrop Grumman (NOC). Auditing and compliance expertise acquired through his role as Chief Audit Executive for Lockheed Martin and his other senior roles at Lockheed Martin relating to internal audit, ethics and enterprise assurance. Auditing and compliance expertise acquired through his role as Chief Audit Executive for Lockheed Martin and his other senior roles at Lockheed Martin relating to internal audit, ethics and enterprise assurance. | Key Qualifications  Decades of experience counseling clients in the technology and consulting space gained from his 32-year tenure with McKinsey & Company, a global management consulting company, where he served in various senior roles, most recently as Chairman, the Americas. Decades of experience counseling clients in the technology and consulting space gained from his 32-year tenure with McKinsey & Company, a global management consulting company, where he served in various senior roles, most recently as Chairman, the Americas. Perspective on managing a global professional services business from his decades of experience in senior leadership at McKinsey & Company. Perspective on managing a global professional services business from his decades of experience in senior leadership at McKinsey & Company. Expertise and insight in the cybersecurity space from his experience as CEO of Stroz Friedberg, a global investigation and cybersecurity firm. Expertise and insight in the cybersecurity space from his experience as CEO of Stroz Friedberg, a global investigation and cybersecurity firm. Extensive experience developing a technology consulting business from his tenure at McKinsey & Company, during which time he led the European Telecoms practice and the firm’s new business growth opportunities around data, analytics and software, among his many senior leadership roles. Extensive experience developing a technology consulting business from his tenure at McKinsey & Company, during which time he led the European Telecoms practice and the firm’s new business growth opportunities around data, analytics and software, among his many senior leadership roles. |

Career Highlights ●Executive positions at Lockheed Martin Corporation (LMT), a global security and aerospace company –Senior Vice President, Ethics and Enterprise Assurance (since 2018) –Senior Vice President, Internal Audit, Ethics and Sustainability (2016 – 2018) –Vice President, Ethics and Sustainability (2011 – 2016) –Vice President, Corporate Business Development and various other positions (2007 – 2011) ●President, Integrated Coast Guard Systems LLC, a joint venture between Lockheed Martin and Northrop Grumman Corporation (NOC) (2005 – 2007) –Vice President and General Manager, Coast Guard Systems, Lockheed Martin’s entity in the joint venture ●Chief Operations Officer of ACS State Healthcare LLC (now part of Conduent), an IT/BPO services company in the healthcare space (2003 – 2005) ●Deputy Secretary and Chief Operating Officer of the United States Department of Veterans Affairs (2001 – 2003) ●Various positions with Bell Helicopter, a helicopter and tiltrotor craft manufacturer (1997 – 2001) Select Other Positions ●Director of Lockheed Martin Ventures ●Director of USAA Federal Savings Bank Select Past Director Positions ●Chairman of the Board of Visitors of the Graduate School of Public Affairs at the University of Maryland ●Center for a New American Security | Career Highlights ●Chairman and Chief Executive Officer of Vidyo, a cloud-based video conferencing services company (2017 – 2019) ●Chief Executive Officer of Stroz Friedberg, a global investigation and cybersecurity firm (2013 – 2017) ●Senior Partner and various other positions with McKinsey & Company, a global management consulting company (1981 – 2013) –Board of Directors (1998 – 2010) –Chairman, the Americas (2003 – 2009) –Member of the Operating Committee –Managing Partner of the New York and New Jersey offices, North American Corporate Finance and Strategy practice and European Telecoms practice –Leader of new business growth opportunities around data, analytics and software Select Other Positions ●Chairman of the Board of MIO Partners, Inc., an investment subsidiary of McKinsey & Company |

Education ●B.S., United States Naval Academy ●M.P.P., Harvard University ●Ph.D., Harvard University | Education ●B.S., University of Sydney ●M.B.A., International Institute for Management Development, Lausanne, Switzerland |

| Key | Committees | |||

| A | Audit Committee | C | Compensation Committee | |

| F | Finance Committee | G | Governance Committee | |

| CHAIR | Committee Chair | + | Audit Committee Financial Expert | |

14 COGNIZANT

| Joseph M. Velli | Sandra S. Wijnberg | |||||||

| Former Senior EVP of The Bank of New York |  | Former Partner, Aquiline Holdings |  | |||||

| Director Since 2017 Age62 Independent | Committees | Birthplace USA  | Director Since 2019 Age63 Independent | Committees | Birthplace USA  | |||

Key Qualifications  Significant experience in creating, building and leading large-scale technology, processing and software platform businesses as a Senior EVP for The Bank of New York (now BNY Mellon) (BK), a Fortune 200, NYSE-listed financial services institution, and as CEO of Convergex Group, a provider of software platforms and technology-enabled brokerage services. Significant experience in creating, building and leading large-scale technology, processing and software platform businesses as a Senior EVP for The Bank of New York (now BNY Mellon) (BK), a Fortune 200, NYSE-listed financial services institution, and as CEO of Convergex Group, a provider of software platforms and technology-enabled brokerage services. Experience in creating, building and leading large-scale technology, processing and software platform businesses as a Senior EVP for The Bank of New York and as CEO of Convergex Group. Experience in creating, building and leading large-scale technology, processing and software platform businesses as a Senior EVP for The Bank of New York and as CEO of Convergex Group. Expertise in the financial services industry gained through his decades of senior leadership experience with The Bank of New York. Expertise in the financial services industry gained through his decades of senior leadership experience with The Bank of New York. Operating experience specific to the financial services industry, having led several key business lines for The Bank of New York, including heading Global Issuer Services, Global Liquidity Services, Pension and 401(k) Services, Consumer and Retail Banking, Correspondent Clearing and Securities Services. Operating experience specific to the financial services industry, having led several key business lines for The Bank of New York, including heading Global Issuer Services, Global Liquidity Services, Pension and 401(k) Services, Consumer and Retail Banking, Correspondent Clearing and Securities Services. Serves on the board of Paychex (PAYX), a provider of payroll, human resource and benefits outsourcing services (since 2007). Serves on the board of Paychex (PAYX), a provider of payroll, human resource and benefits outsourcing services (since 2007). Expertise managing large, global enterprises gained through his senior leadership roles at The Bank of New York. Expertise managing large, global enterprises gained through his senior leadership roles at The Bank of New York. | Key Qualifications  A wealth of experience managing a technology and consulting company gained through her role as CFO of Marsh & McLennan Companies (MMC), a global professional services company. A wealth of experience managing a technology and consulting company gained through her role as CFO of Marsh & McLennan Companies (MMC), a global professional services company. Experience running a large, global professional services business from her role as CFO at Marsh & McLennan Companies. Experience running a large, global professional services business from her role as CFO at Marsh & McLennan Companies. Expertise in the insurance and investment management sectors, having served as CFO of Marsh & McLennan Companies, and expertise with registered investment company regulations, having served in executive and advisory capacities for Aquiline Holdings, a registered investment advisory firm. Expertise in the insurance and investment management sectors, having served as CFO of Marsh & McLennan Companies, and expertise with registered investment company regulations, having served in executive and advisory capacities for Aquiline Holdings, a registered investment advisory firm. Serves on the boards of T. Rowe Price Group (TROW), a global asset management firm (since 2016), and Automatic Data Processing (ADP), a provider of human resources management software and services (since 2016). Serves on the boards of T. Rowe Price Group (TROW), a global asset management firm (since 2016), and Automatic Data Processing (ADP), a provider of human resources management software and services (since 2016). Expertise managing large, global enterprises gained through her roles as CFO of Marsh & McLennan Companies and interim CFO of YUM! Brands, a global operator and franchisor of quick service restaurants. Expertise managing large, global enterprises gained through her roles as CFO of Marsh & McLennan Companies and interim CFO of YUM! Brands, a global operator and franchisor of quick service restaurants. Finance, accounting and risk management expertise having served as CFO of Marsh & McLennan Companies, a leading professional services firm in the areas of risk, strategy and people, and interim CFO of YUM! Brands. Finance, accounting and risk management expertise having served as CFO of Marsh & McLennan Companies, a leading professional services firm in the areas of risk, strategy and people, and interim CFO of YUM! Brands. |

Career Highlights ●Advisory Council Member of Lovell Minnick Partners, LLC, a private equity firm (since 2016) ●Chairman and CEO of Convergex Group, LLC, a provider of software platforms and technology-enabled brokerage services (2006 – 2013) ●Executive positions with The Bank of New York (now BNY Mellon) (BK), a Fortune 200, NYSE-listed financial services institution –Senior Executive Vice President and member of the Senior Policy Committee (1998 – 2006) –Executive Vice President (1992 – 1998) –Other leadership positions (1984 – 1992) Current Public Company Boards ●Computershare Limited, a global provider of corporate trust, stock transfer, employee share plan and mortgage servicing services listed on the Australian Securities Exchange (since 2014) ●Paychex, Inc. (PAYX), a provider of payroll, human resource and benefits outsourcing services (since 2007) Select Past Director Positions ●E*Trade Financial Corporation | Career Highlights ●Deputy Head of Mission, Jerusalem, Office of the Quartet, recruited by the U.S. Department of State to advance the Quartet’s Palestinian economic development mandate (2014 – 2016) ●Executive and advisory roles with Aquiline Holdings, LLC, a registered investment advisory firm –Executive Advisor (2015 – 2019) –Partner, Chief Administrative Officer (2007 – 2014) ●Senior Vice President and Chief Financial Officer of Marsh & McLennan Companies, Inc. (MMC), a global professional services company (2000 – 2006) ●Executive-level finance roles in the food and beverages industry –Senior Vice President, Treasurer and ultimately interim Chief Financial Officer of Yum! Brands, Inc., a global operator and franchisor of quick service restaurants (1997 – 1999) –Chief Financial Officer, KFC Corporation at PepsiCo, Inc. (PEP) (1996 – 1997) –Vice President and Assistant Treasurer, PepsiCo, Inc. (1994 – 1996) Current Public Company Boards ●T. Rowe Price Group, Inc. (TROW), a global asset management firm (since 2016) ●Automatic Data Processing, Inc. (ADP), a provider of human resources management software and services (since 2016) Select Past Director Positions ●Tyco International, Inc. (now Johnson Controls International plc) (2003 – 2016) ●Tyco Electronics Ltd. (now TE Connectivity Ltd.) (2007 – 2009) |

Education ●B.A., William Paterson University ●M.B.A., Fairleigh Dickinson University | Education ●B.A., University of California, Los Angeles ●M.B.A., University of Southern California, Marshall School of Business |

| Key Qualifications | |||||||

| Public Company Leadership |  | Security |  | Public Company Governance | ||

| Technology and Consulting Services |  | Regulated Industries |  | International Business Development | ||

| Talent Management |  | Operations Management |  | Finance, Accounting and Risk Management | ||

2020 PROXY STATEMENT 15

Audit Committee Number of meetings in 2019:9 | Chair | Other Members |

Key Responsibilities

Oversight of: ●The contents and integrity of the company’s financial information reported to the public and the adequacy of the company’s internal controls ●The appointment, qualifications, independence and performance of the company’s independent registered public accounting firm ●The performance of the company’s internal audit and ethics and compliance functions ●The review and evaluation of the company’s enterprise risk management program ●The review and evaluation of the company’s management of third party and contractual risks | 2020 changes ✚Added responsibilities of assisting the board with respect to the review and evaluation of the company’s management of security (including cybersecurity) and data privacy risks (moved from Governance Committee) ✚Added responsibility of reviewing and evaluating the company’s tax planning and strategy (moved from Finance Committee) Notable Recent Activities ●Oversight of our U.S. Foreign Corrupt Practices Act matter, which we resolved with the U.S. Department of Justice and U.S. Securities and Exchange Commission (“SEC”) in February 2019 | Additional Independence Requirements All members of the Audit Committee ●May not accept any direct or indirect consulting, advisory or other compensatory fee from the ●May not be affiliated with the

|

Finance and Strategy Committee Number of meetings in 2019:5 | Chair | Other Members |

Key Responsibilities In 2019 Oversight of certain financial and operations matters, including: ●Operating margins ●Capital structure and allocation ●Dividend policies and stock repurchase programs ●Talent supply chain ●Business continuity planning ●Scalability of corporate processes and systems ●Assisting the board with respect to M&A program strategy and execution ●Tax strategy and planning ●Treasury matters, including hedging strategies | 2020 changes ✚Added responsibility of assisting the board with respect to the development of the company’s corporate plans, strategies and objectives −Tax strategy and planning responsibility moved to the Audit Committee | Notable Recent Activities ●Oversight of M&A program, with $695 million in capital deployed for acquisitions in 2019 (seepage 3) ●Oversight of capital allocation program, with $2.2 billion in share repurchases undertaken in 2019 (seepage 3) and an increase in the company’s quarterly dividend implemented in Q1 2020 |

16 COGNIZANT

Management Development and Compensation Committee Number of meetings in 2019:11 | Chair | Other Members |